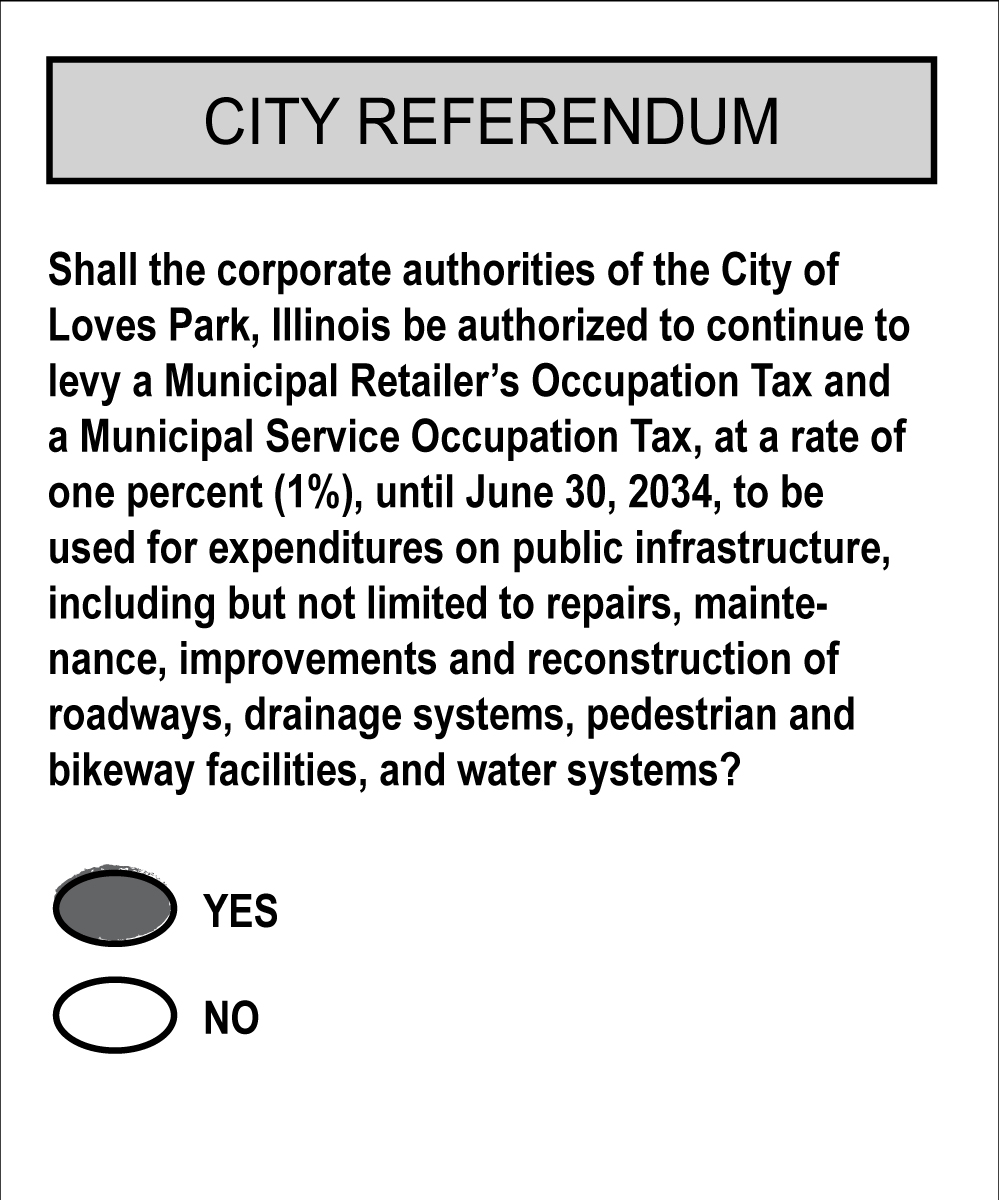

PROPOSITION TO CONTINUE TO IMPOSE A NON-HOME RULE MUNICIPAL RETAILERS’ OCCUPATION TAX AND A NON.HOME RULE MUNICIPAL SERVICE OCCUPATION TAX FOR EXPENDITURE ON PUBLIC INFRASTRUCTURE

Summary of Road Spending Since July 2014 Road Referendum |

|||||||||

| Expended | 1% tax Collected | Collections less expenditures by year | Alpine Roads Borrowed Funds | ||||||

| FY2022 | $ | 2,442,882.86 | $ | 3,111,878.55 | $ | 668,995.69 | |||

| FY2021 | $ | 1,953,693.04 | $ | 3,121,530.02 | $ | 1,167,836.98 | COVID | ||

| FY2020 | $ | 4,069,749.88 | $ | 2,833,791.18 | $ | -1,235,958.70 | |||

| FY2019 | $ | 2,903,735.13 | $ | 2,617,491.18 | $ | -286,243.95 | |||

| FY2018 | $ | 6,220,472.77 | $ | 2,607,653.03 | $ | -3,612,819.74 | |||

| FY2017 | $ | 5,446,624.30 | $ | 2,510,579.31 | $ | -2,936,044.99 | |||

| FY2016 | $ | 6,005,557.23 | $ | 2,482,468.39 | $ | -3,523,088.84 | $ | 8,500,000.00 | Bond issue for Alpine Road 10/2015 |

| FY2015 | $ | 926,095.00 | $ | 1,879,140.94 | $ | 953,045.94 | 7/1/14 tax implemented | ||

| Total | $ 29,968,810.21 | $ | 21,164,532.60 | $ | -8,804,277.61 | $ | 8,500,000.00 | Overlays/Reconstruction/Debt Service | |

Pre-Referendum Road Spending |

|||||||||

| FY2014 | $ | 663,853.00 | |||||||

| FY2013 | $ | 326,153.00 | |||||||

| FY2012 | $ | 309,632.00 | |||||||

| FY2011 | $ | Implemented Utility Tax | |||||||

| FY2010 | $ | ||||||||

| FY2009 | $ | 110,000.00 | |||||||

Updated 4/12/22

Road Spending Since 2014 Road Referendum updated 4/12/22

Alpine Road Bond |

||||||||||

| Fiscal Year | Overlay | Debt Service | Road | Totals | Fiscal Year | MET $$ or Grant $$ | Stormwater | |||

| FY 2022 | $ 925,000.00 | 1,304,949.86 | 212,933.00 | Engineering future proj. | $2,442,882.86 | FY2022 | $ | 1,057,091.50 | $ 394,745.28 | |

| FY2021 | 1,308,614.30 | 645,078.74 | Eng. future proj.& Reconstr.Heart Rd. | $1,953,693.04 | FY2021 | $ 158,112.61 | ||||

| FY 2020 | $988,554.00 | 1,311,879.66 | 1,769,316.22 | Bell School & engineering future | $4,069,749.88 | FY2020 | $ | 57,879.00 | ||

| FY 2019 | $ 567,050.00 | 1,314,745.00 | 1,021,940.13 | Pike Road | $2,903,735.13 | FY2019 | ||||

| FY 2018 | $ 1,879,627.00 | 169,745.00 | 4,171,100.77 | Alpine Phase III | $6,220,472.77 | FY2018 | $ | 413,564.30 | ||

| FY 2017 | $ 1,274,723.99 | 189,548.58 | 3,982,351.73 | Alpine Phase II | $5,446,624.30 | FY2017 | 630,445.12 | |||

| FY 2016 | $ 786,845.00 | Bond Issue | 5,218,712.23 | Alpine Phase 1 | $6,005,557.23 | FY2016 | $ | 1,319,614.72 | ||

| FY 2015 | $ 926,095.00 | 7/1/14 tax Implemented | $926,095.00 | P12015 | 183,558.44 | |||||

| Totals: | $ 7,347,894.99 | 5,599,482.40 | $ 17,021,432.82 | $ 29,968,810.21 | Totals: | $ | 3,604,274.08 | $610,736.89 | ||

| Pre-Referendum Road Spending | ||||||||||

| FY 2014 | 651,456.00 | 12,397.00 River Lane Engineering | $ | $663,853.00 | FY2014 | $ | 1,232,245.22 | |||

| FY 2013 | 326,153.00 | $ | $326,153.00 | FY2013 | 195,753.96 | |||||

| FY 2012 | 309,632.00 | $ | $309,632.00 | P12012 | ||||||

| FY 2011 | Implemented Utility Tax | FY2011 | ||||||||

| FY 2010 | FY2010 | |||||||||

| FY 2009 | 110,000.00 | $ | $110,000.00 | FY2009 | ||||||